Betting Exchange Order Book: Price, Depth & Fills

TL;DR: The order book (“ladder”) on the lists price levels (decimal odds) and available size where traders want to transact. Use limit orders to name your price and reduce slippage; use market orders to trade instantly when timing matters. With our smaller tick size and 3-decimal quotes, you can place more precise limits (e.g., 1.785) to tighten spreads and improve your average fill.

SX Bet Odds Ladder Update: Finer Ticks, Better Control

We’ve halved the odds tick size from 0.25% → 0.125% and enabled three-decimal quoting for limits. That means:

- Tighter spreads: Smaller steps between prices naturally compress the gap between best buy/sell.

- More precise quotes: Post a price like 1.785 instead of being forced to choose 1.78 or 1.79.

- Better average fills: You can “slice” your edge instead of overpaying a whole tick.

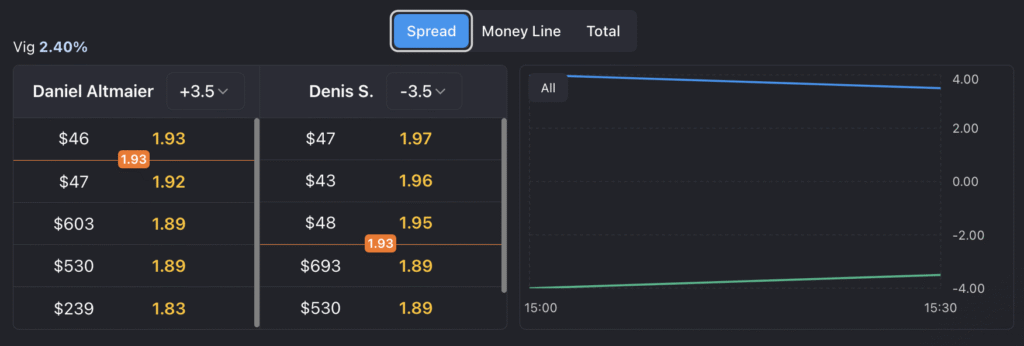

What the Order Book (Ladder) Shows

The order book is a live list of resting interest at each decimal-odds price:

- Best price (top of book): Most competitive price you can trade right now.

- Depth: Total size resting at each level behind best price.

- Spread: Gap between best buy and best sell (wider = more cost to cross with market orders).

Reading the ladder well tells you whether to rest a limit near fair value, move a price to get filled, or use a market order if speed matters more than price control.

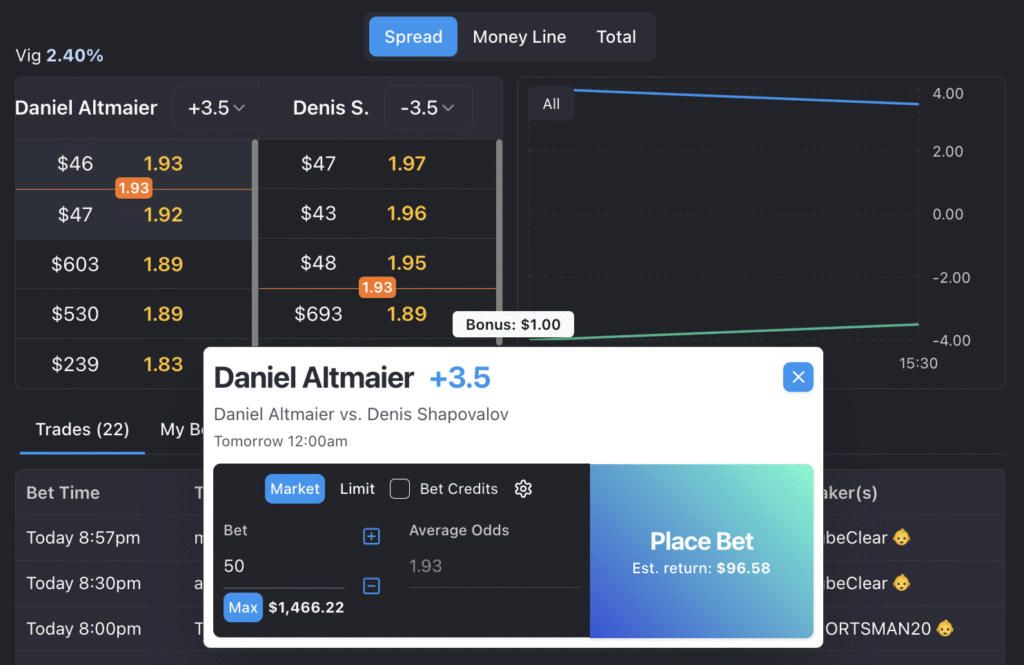

Limit vs. Market Orders on SX Bet

Limit order (price control)

- You set the max buy / min sell price you’ll accept.

- Pros: Often better average odds; can sit between ticks (e.g., 1.785) and earn queue priority.

- Cons: Might not fill immediately; can fill partially across time.

Market order (speed)

- You take the best available price(s) now.

- Pros: Immediate entry—useful in in-play or newsy moments.

- Cons: Can walk the ladder if depth is thin → slippage (worse average than top of book).

Rule of thumb: If price control is the priority, rest a limit; if timing is the priority, use market—ideally with a size cap so you don’t chew through multiple levels.

Slippage on SX Bet: Defaults, Per-Bet Controls, and Exact-Price Mode

What is slippage?

Slippage is the % range you’re willing to accept if odds move slightly before your bet confirms.

Your controls on SX Bet

- Default max slippage: 1% (change it anytime in Settings).

- Per-bet max slippage: On the bet slip, click the gear icon → choose a one-off max slippage for that bet.

- Exact-price mode (0%): Set slippage to 0% to only accept your exact odds or better—never worse.

Quick math (buy example):

If you select 1.80 with 1% slippage, you’ll accept odds down to 1.80 × (1 − 0.01) = 1.782 if price ticks during confirmation. At 0%, the bet won’t confirm below 1.80.

When to use which:

- 0% when you must have an exact price (you may miss fills).

- 0.5–1% for live markets where tiny moves are common.

- Higher tolerance only if the market is thin/volatile and entry > price perfection.

Odds Boost: Benchmarking Your Price (At a Glance)

Odds Boost compares the SX price to a sharp sportsbook benchmark, so you can spot instant price advantage quickly. Use it to:

- Validate your intended limit (is SX already best price?).

- Decide whether to rest (seek better) or take (market) based on relative edge.

- Prioritize markets with consistent positive deltas.

Where to add an image: Crop of the Odds Boost panel (no sensitive data). ALT: “SX Bet Odds Boost comparing exchange price to a sharp sportsbook.”

How Depth Shapes Your Average Fill (With Example)

Suppose the ask side shows:

- 1.78 — $300

- 1.79 — $400

- 1.80 — $600

If you market buy $500, you’ll probably fill $300 @ 1.78 and $200 @ 1.79. Your weighted-average odds:

Avg Odds=300×1.78+200×1.79500=1.784\text{Avg Odds}=\frac{300\times1.78 + 200\times1.79}{500}=1.784Avg Odds=500300×1.78+200×1.79=1.784

If you instead rest a $500 limit @ 1.785 and it fills, your average would be 1.785—a small but material improvement over time.

Takeaway: Depth determines whether market orders “walk the ladder.” Precise limits can defend your average price.

Spread, Queues, Partial Fills & Cancellations

- Spread: Wider spreads mean more price to cross with a market order; fine ticks help compress spreads.

- Queues: At a given price, resting limits are typically matched in time priority (earlier orders first). Posting earlier at a popular level can determine whether you get filled.

- Partial fills: You might be filled in pieces across one or more levels/times; your position reflects the size-weighted average.

- Cancellation costs: Cancelling and re-posting at the same price generally loses your place in queue. If you need to adjust, consider nudging price (e.g., from 1.78 → 1.785) rather than repeatedly re-adding at 1.78.

In-Play Delay & Matching (What to Expect)

- In-play delay: SX uses a ~3–8 second delay (varies by sport/league) on live markets to protect fairness and reduce front-running.

- With V2, your bet is matched after the delay. Combined with your slippage setting, this can improve the chance of getting filled even if the price inches within your tolerance during that short window.

- Practical flow: In fast markets, consider sending a small market order (with sensible slippage) to secure exposure, then layer limits (e.g., 1.785 / 1.79 / 1.795) to improve your blended average.

Practical Plays Using 3-Decimal Ticks

- Edge-slice a crowded level: If 1.78 is stacked, try 1.785 to get priority without conceding to 1.79.

- Ladder your size: Split a big order into 1.785 / 1.79 / 1.795 to smooth your average if only part fills.

- Pre-position for news: Post early at a precise level you like; if the market trades there, your queue priority pays off.

- Cap market size: If you must trade now, cap the market order to avoid deep slippage, then add limits around the target.

- Review fills weekly: Track top-of-book at send vs average fill to see whether you should use more limits, smaller market bites, or different tick placements.

Quick Math & References (Keep Handy)

- Implied probability: p=1/Op = 1/Op=1/O (e.g., 2.00 → 50%, 2.10 → 47.62%)

- Odds from probability: O=1/pO = 1/pO=1/p

- Weighted-average odds: ∑(size×odds)/∑size\sum(\text{size}\times\text{odds}) / \sum\text{size}∑(size×odds)/∑size

- Allowed min odds with slippage s%s\%s% (buy): Omin=Oselected×(1−s)O_{\min} = O_{\text{selected}}\times(1 – s)Omin=Oselected×(1−s)

- Simple slippage check: (AvgFill−TopOfBookAtSend)/TopOfBookAtSend(\text{AvgFill} – \text{TopOfBookAtSend}) / \text{TopOfBookAtSend}(AvgFill−TopOfBookAtSend)/TopOfBookAtSend

Where to add an image: Compact “cheat sheet” graphic (probability↔odds, slippage formula). ALT: “Odds, implied probability, and slippage cheat sheet.”

It’s the maximum % move you’ll accept if odds change slightly before your bet confirms. You can set a default (Settings) and a per-bet tolerance (gear icon).

Your bet will only be matched at the exact price you selected, or better—never worse. You may miss fills if the market moves away.

Finer ticks let you post between common levels, tighten spreads, improve queue position, and express edge without overpaying a whole tick.

That’s a partial fill. Your order executed in pieces; your position shows the size-weighted average of all fills.

If you re-post at the same price, you typically lose time priority in queue. Adjust in small price steps instead.

Live bets queue for ~3–8 seconds (by sport/league) to protect fairness, then match. Your slippage setting controls how much movement you’ll accept during that window.